Established in 1934, Lower Columbia College was founded during the Great Depression by community leaders seeking a better future for high school graduates. Today, LCC is a comprehensive community and technical college offering 70+ programs and serving over 4,000 students each year. Recognized for its excellence in nursing, workforce training, academic preparation, and athletics, the college serves as the educational center for the entire Lower Columbia Region. LCC Campaigns elevate opportunity for our students and our region. Funds will be raised over three years, 2023 through 2025.

Foundation names 2025-2026 Benefactor of the year Richar Nau, MD

The Lower Columbia College Foundation has named Dr. Richard Nau as the 2025-26 Benefactor of the Year. Benefactor honorees have a history of providing financial support to the foundation and/or significant volunteer service to the college. Most notably, contributions from honorees have substantially impacted college programs, students, and the community... Read the full article

Meet Courtney, an LCC Scholarship Recipient

This year, we met Courtney, a Criminal Justice and Psychology student who faced a life-changing accident and serious financial hardship. Just ten days into the winter quarter, she was struck by a vehicle and sustained multiple injuries. Facing a long recovery and determined to continue her education, Courtney maintained a 4.0 GPA with the support of her professors and staff at LCC.

“I’ve learned the importance of asking for help,” Courtney says. “Leaning on the support of others has made it possible for me to keep moving forward.”

Despite adversity, Courtney has persevered and now envisions a future helping at-risk youth in the juvenile justice system here in Cowlitz County.

In this season of gratitude, students like Courtney remind us of the transformational power of education and the impact your support makes.

As you consider your year-end giving, we hope you’ll include the Lower Columbia College Foundation among the causes you support.

Giving is easier than ever—you can make your tax-deductible gift online through the LCC Foundation. Please consider giving by December 31 to make the greatest impact for our students.

The Opportunity Can’t Wait Campaign has already raised over $14.4 million to support scholarships, athletics facilities, and the new Center for Vocational & Transitional Studies. In addition, the Washington State Legislature approved $45.2 million for the new center—construction is now underway.

The LCC Family—faculty, staff, and retirees—plays a key role in carrying the campaign across the finish line. Every gift matters, whether through payroll deduction, estate planning, or giving in honor/memory of a colleague.

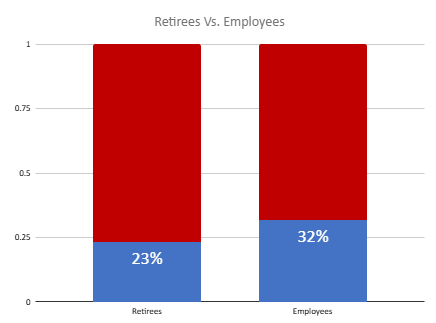

Campaign activities include Wear Your Support Wednesdays, trivia, prize patrols, and more fun events leading up to the campaign’s close on October 17. A friendly challenge is also underway: current employees vs. retirees in a participation competition, with a celebratory event for the winning group.

The new Welding Lab in the Center for Vocational & Transitional Studies will be named in honor of Allan Evald, who taught welding at LCC for 25 years. Known for his dedication and impact on countless students, Allan’s legacy is being recognized through a tribute made possible in part by the LCC Family Giving Campaign. This lasting recognition ensures future students will know his name and the difference he made in vocational education.

Make a one-time gift to Lower Columbia College online. Click the Button below to get started!

Make a one-time gift or make a recurring donation and have it deducted right from payroll to avoid the fuss. Learn more and download your Employee Giving Form:

Through a planned gift to the Lower Columbia College Foundation, you create a significant and lasting impact on the lives of students in pursuit of higher education as well as ensuring the college's commitment to educational excellence well into the future.

Thank you for making a difference!

P.S. Because of YOU, your investment in students’ lives, and the future of our community, we look ahead to 2025 with great anticipation! Maximize your impact through smart giving options like stock donations, IRA Qualified Charitable Distributions, or a gift in your will or estate plans. Together, we can change lives!

Contact the Lower Columbia College Foundation

We look forward to hearing from you! Make an appointment by calling (360) 442-2130. Walk-ins welcome during regular business hours. The Foundation is a tax-exempt 501(c)(3) non-profit organization. Your gifts are tax deductible to the extent permitted by law.

Donor Relations

Kendra Sprague, Vice President of

Foundation, HR & Legal Affairs

(360) 442-2121

ksprague@lowercolumbia.edu

General Inquiries

(360) 442-2130

Fax: (360) 442-2129

foundation@lowercolumbia.edu

Donor Relations & Major Gifts

Sheila Timm, Foundation Director of Development & Major Gifts

(360) 442-2132

stimm@lowercolumbia.edu

Foundation on Facebook

Like our Facebook page for the latest news & updates!

Scholarships

Emilee Bollibon, Foundation Development Associate

(360) 442-2136

ebollibon@lowercolumbia.edu

Foundation on Flickr

See pictures of all our events!